Importance of selecting the appropriate broker for individual trading preferences.

Understanding Your Trading Needs:

- Type of Trading: Are you looking into day trading, swing trading, or long-term investing?

- Trading Volume: How frequently you plan to trade.

- Investment Size: The amount of capital you intend to invest.

Key Factors to Consider When Choosing a Broker:

- Fees & Commissions: Understand the cost structure.

- Platform & Tools: The usability, tools available, and if they cater to your trading style.

- Customer Support: Importance of responsive and knowledgeable customer service.

- Regulations: Ensure the broker is regulated by a recognized authority.

Types of Brokers:

- Full-Service Brokers: Offering comprehensive services including advice, research, and more. These brokers offer a comprehensive suite of services including personalized advice, research, portfolio management, and more. They typically charge higher fees but provide a hands-on approach tailored to the client.

- Merrill Lynch: Known for its wide range of services and global presence.

- Morgan Stanley: Renowned for its research and wealth management services.

- UBS: A global giant, providing personalized financial advice.

- Discount Brokers: For those who prefer a hands-on approach without extra services. These brokers are for traders who prefer a do-it-yourself approach. They offer lower fees in comparison to full-service brokers but may not offer personalized advice or research.

- ETRADE: Popular for its user-friendly platform and comprehensive research tools.

- TD Ameritrade: Known for its extensive educational resources and powerful trading platforms.

- Charles Schwab: Combines a robust platform with physical branches for in-person support.

- Direct Market Access Brokers: For advanced traders looking for faster execution. or advanced traders looking for faster trade executions without the intermediary of market makers. These brokers are typically for high-frequency traders.

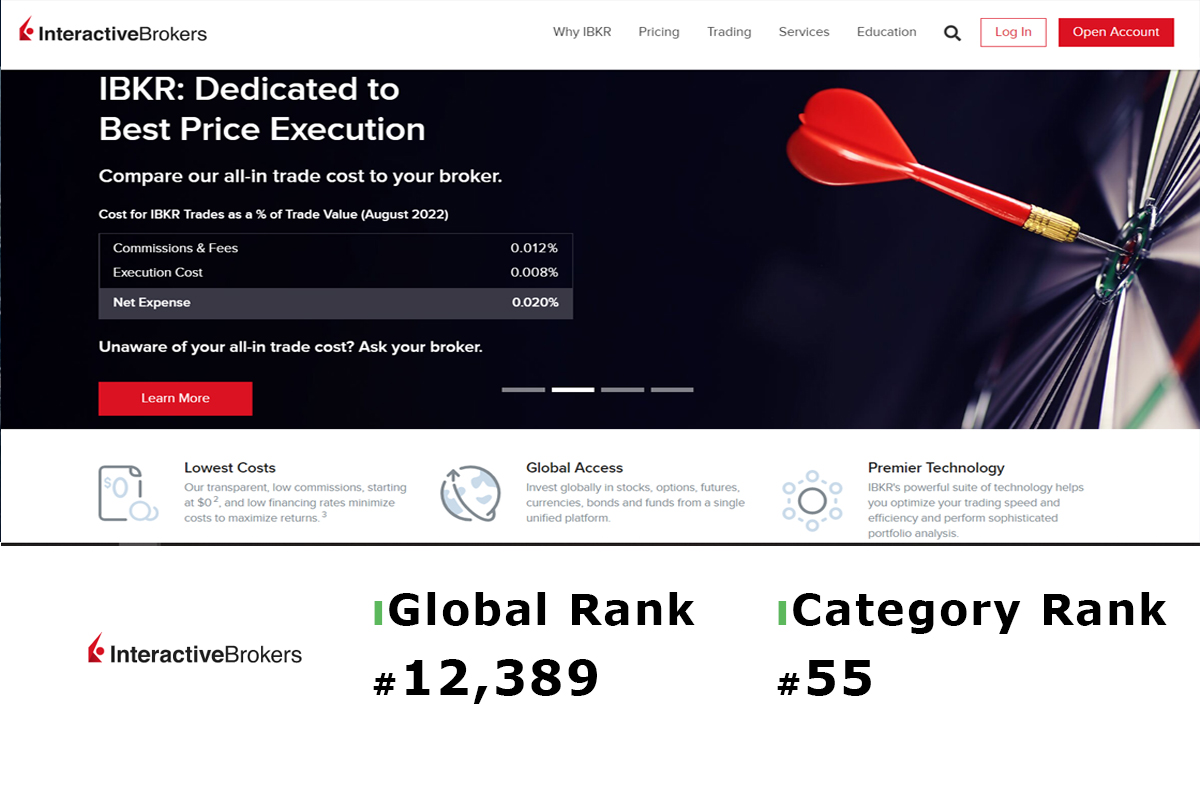

- Interactive Brokers: Recognized for its advanced trading tools and direct market access.

- XTB International: Known for its lightning-fast trade executions.

- TradeStation: Popular among professional traders for its customizable platform.

Additional Features to Look For:

- Educational Resources: Webinars, articles, and tutorials for all levels of traders.

- Mobile Trading: Evaluate the quality of mobile applications.

- Demo Accounts: The ability to practice trading with virtual money.

The importance of due diligence in selecting a broker that aligns with individual needs and goals.