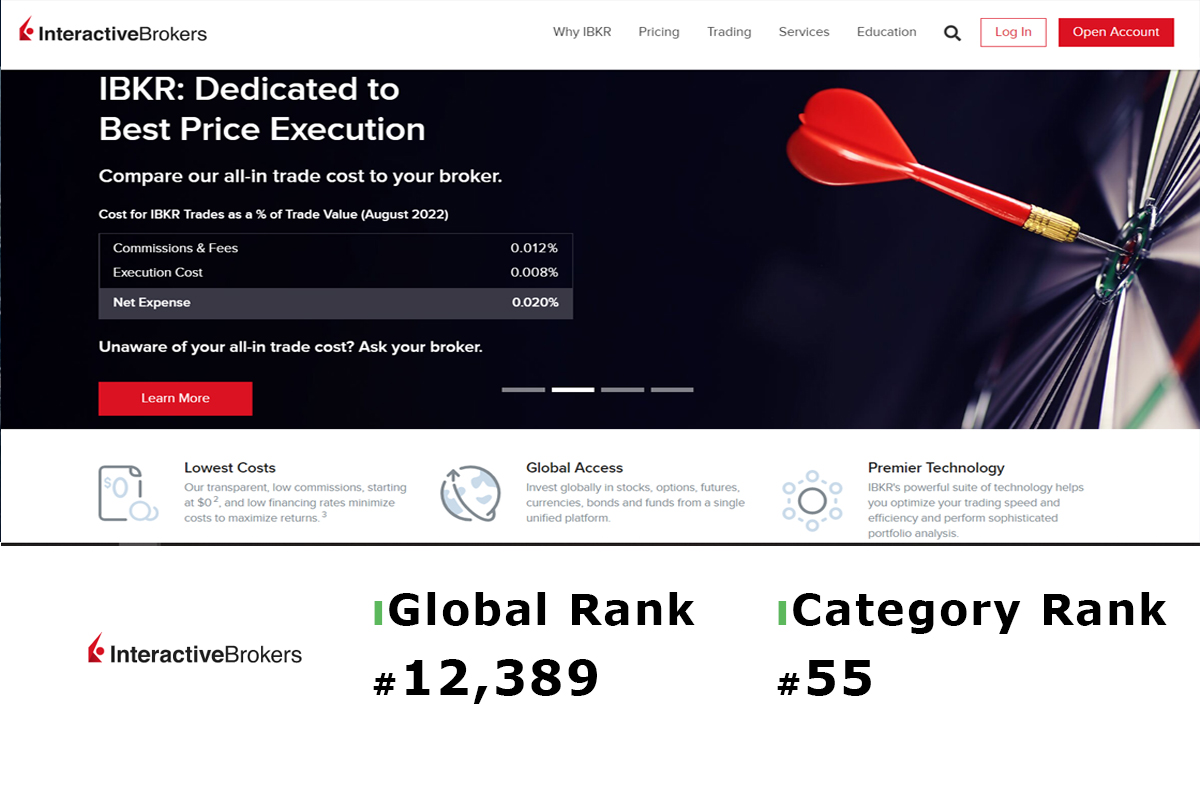

Online trading platforms are evolving rapidly to offer newer features and technologies to cater to the ever-growing demands of retail traders. Interactive Brokers is a platform that has been around since the 1970s and has been constantly innovating its platform to keep up with the changing market trends. This article aims to provide a comprehensive review of Interactive Brokers, including its pros, cons, and features.

A Deep Dive into the Trading Platform

Interactive Brokers offers a wide range of trading products and services. The platform is suitable for both novice and advanced traders. It has a user-friendly interface, which is easy to navigate. The dashboard provides an overview of account balances, portfolio performance, and current market data.

Interactive Brokers provides a range of research tools to help traders make informed trading decisions. The platform offers market analysis, news articles, and analyst ratings. It also has a range of charting tools, including technical indicators and drawing tools.

Interactive Brokers’ trading platform is highly customizable. Traders can customize their dashboard to suit their individual preferences. They can also customize their order types, including limit orders, stop-loss orders, and trailing stop orders. The platform also supports advanced order types such as iceberg orders and time-weighted average price orders.

Unveiling the Pros, Cons, and Features of Interactive Brokers

One of the main advantages of Interactive Brokers is its low trading fees. The platform charges very low fees for trading stocks, options, futures, and ETFs. It also offers a wide range of investment products such as mutual funds, bonds, and forex.

Another advantage of Interactive Brokers is its advanced trading platform. The platform provides a range of tools and features to help traders make informed trading decisions. Its customizable dashboard, advanced order types and research tools make it a popular platform among advanced traders.

One of the disadvantages of Interactive Brokers is its high initial account balance requirement. The platform requires a minimum deposit of $2,000 to open an account. Another disadvantage is its complex pricing structure, which can be confusing for novice traders. Additionally, the platform does not offer much in terms of educational resources for novice traders.

Interactive Brokers is a popular platform among advanced traders due to its advanced trading platform and low trading fees. However, its complex pricing structure and high initial account balance requirement make it less suitable for novice traders. Overall, Interactive Brokers is a solid platform that offers a wide range of investment products and services to cater to the needs of different types of traders.