With the rise of cryptocurrencies, new avenues for investment and earning passive income have emerged. One such method is crypto staking, which allows individuals to stake their digital assets and earn rewards in return. In this article, we will delve into the world of crypto staking, exploring its mechanisms, operation, benefits, risks, and the platforms that facilitate this process. By the end, you will have a comprehensive understanding of crypto staking and its potential in the future of finance.

Introduction to Crypto Staking

Crypto staking can be defined as the process of participating in a blockchain network by holding and “staking” a specific cryptocurrency in a wallet to support its operations. By doing so, participants contribute to the network’s security, consensus, and validation mechanisms. In return, they receive rewards in the form of additional cryptocurrency tokens. This incentivizes network participants to hold and maintain a certain amount of the cryptocurrency, ensuring network stability and security.

Exploring Staking Mechanisms

Different cryptocurrencies employ various staking mechanisms, each with its own set of rules and requirements. The two primary staking mechanisms are Proof of Stake (PoS) and Delegated Proof of Stake (DPoS). PoS involves participants staking their tokens, locking them in a wallet, and actively participating in the consensus process. DPoS, on the other hand, allows token holders to delegate their staking power to trusted network validators, who then perform the necessary functions on their behalf. These mechanisms are designed to incentivize participants to hold and secure the network, ensuring a more efficient and secure blockchain.

The Operation of Crypto Staking

To participate in crypto staking, individuals need to possess the specific cryptocurrency and a compatible wallet. They then lock a predetermined amount of tokens in the wallet and designate it as a staking wallet. The staked tokens are typically locked for a specific period, during which participants cannot sell or transfer them. The staking process involves actively validating transactions, proposing new blocks, or delegating staking power to network validators. Successful participation in staking rewards participants with additional tokens, which are added to their staking wallet.

Benefits and Risks of Staking

Crypto staking offers several benefits to participants. Firstly, it provides an opportunity to earn passive income by simply holding and staking digital assets. This can be particularly attractive in a volatile market, as staking rewards provide stability to an investment portfolio. Additionally, staking helps secure the blockchain network by decentralizing the consensus process and reducing the risk of potential attacks. However, staking also carries certain risks, such as the loss of staked assets due to technical issues or vulnerabilities in the network. Participants must carefully weigh the potential rewards against these risks before engaging in staking.

Staking Providers and Platforms

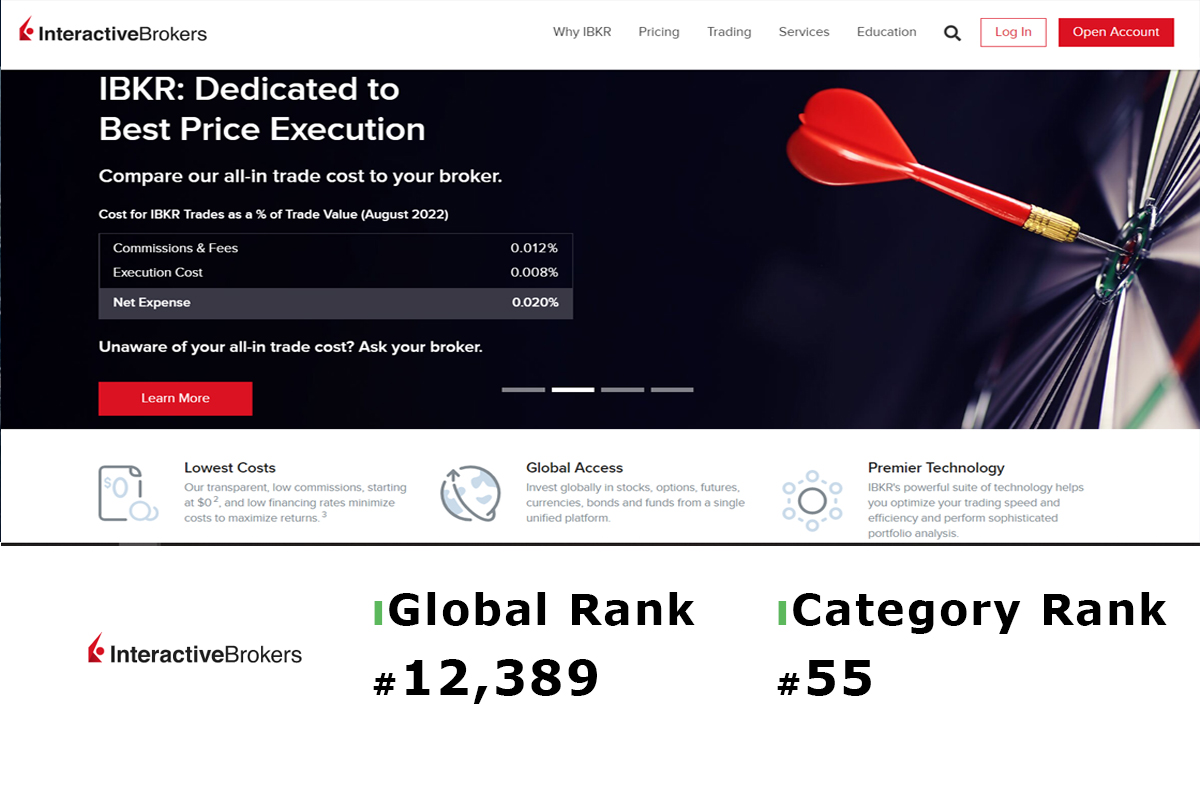

A variety of platforms and staking providers have emerged to facilitate the staking process for individuals. These platforms offer user-friendly interfaces, secure wallets, and simplified staking procedures. Some popular staking platforms include Coinbase, Binance, and Kraken. These platforms often provide additional features, such as staking pools, which allow participants to combine their staking power for increased chances of earning rewards. When choosing a staking provider, individuals should consider factors like reputation, security measures, fees, and the supported cryptocurrencies.

Future Perspectives on Crypto Staking

As the cryptocurrency ecosystem continues to evolve, crypto staking is expected to play an increasingly important role. It offers a sustainable economic model for blockchain networks, encouraging network participation and stability. Moreover, the implementation of staking mechanisms in major cryptocurrencies like Ethereum will likely lead to significant advancements in scalability and energy efficiency. Additionally, with the emergence of decentralized finance (DeFi) applications, staking can provide collateral for lending, borrowing, and other financial services. The future of crypto staking seems promising, and it will undoubtedly shape the landscape of blockchain technology and digital asset management.

Mastering Crypto Staking

Crypto staking has transformed the traditional investment landscape, providing individuals with an opportunity to earn passive income while contributing to blockchain networks’ security and consensus. By understanding the mechanisms, operation, benefits, risks, and available platforms, you can make informed decisions when it comes to staking your digital assets. As the cryptocurrency ecosystem continues to evolve, crypto staking will likely witness further advancements and integration into mainstream finance. So, seize the opportunity, explore the world of crypto staking, and unlock the potential rewards it holds.